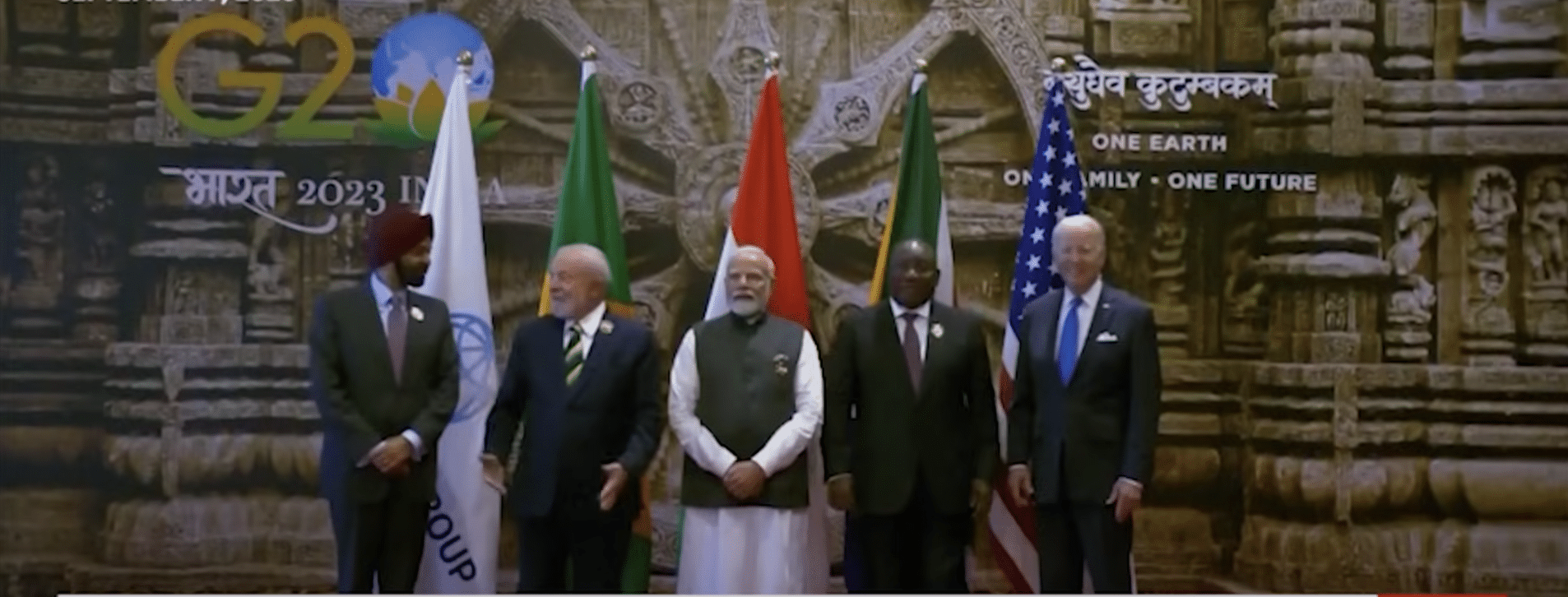

The Group of 20 leaders have agreed to a plan to eventually impose digital currencies and digital IDs on their respective populations, despite fears that governments will use them to monitor their peoples’ spending and crush dissent.

The G20, which is currently under India’s presidency, adopted a final declaration on the subject over the weekend in New Delhi. The meeting, which included the world’s leading economies, announced last week that they had agreed to build the necessary infrastructure to implement digital currencies and IDs.

The group said that discussions were already underway to create international regulations for cryptocurrencies, but claimed that there was “no talk of banning cryptocurrency” at the summit.

Many critics are concerned that governments and central banks will eventually regulate cryptocurrencies and then immediately replace them with central bank digital currencies (CBDCs), which lack similar privacy and security.

Indian Finance Minister Nirmala Sitharaman said that discussions were underway to build a global framework to regulate crypto assets since they believe cryptocurrencies can not be regulated efficiently without total international cooperation.

“India’s [G20] presidency has put on the table key issues related to regulating or understanding that there should be a framework for handling issues related to crypto assets,” Ms. Sitharaman said before the G20 gathering.

The top items discussed at the New Delhi summit included “building Digital Public Infrastructure, Digital Economy, Cryptoassets, [Central Bank Digital Currencies].”

Gita Gopinath, the International Monetary Fund’s first deputy managing director, said in a video posted on X that the G20 “helped shape a global perspective on how policymakers should deal with crypto assets.”

She also assured Business Today that there was “no talk of banning cryptocurrencies, indicating a global consensus against such measures” in the discussions.

However, some of the suggestions call for additional policing of cryptocurrencies, which are decentralized and do not operate under central banks’ control.

Critics say that these proposals could allow government authorities to impose a social credit score system and decide how their citizens can spend their money.

At the summit, European Commission President Ursula von der Leyen called for an international regulatory body for artificial intelligence (AI), digital ID systems similar to coronavirus vaccine passports and advocated for global cooperation to address the challenges presented by AI.

She called for the United Nations to have a role in AI regulation and called the European Union’s COVID-19 digital certificate a perfect model for digital public infrastructures (DPI), which would include digital IDs.

“Many of you are familiar with the COVID-19 digital certificate. The EU developed it for itself. The model was so functional and so trusted that 51 countries on four continents adopted it for free,” said President von der Leyen.

“Today, the WHO uses it as a global standard to facilitate mobility in times of health threats. I want to thank Dr. Tedros again for the excellent cooperation,” she said, referring to WHO Director-General Tedros Adhanom Ghebreyesus.

The European Union is currently trying to introduce a bloc-wide “digital identity” app that would consolidate various personal information, including passports, driver’s licenses, and medical history.