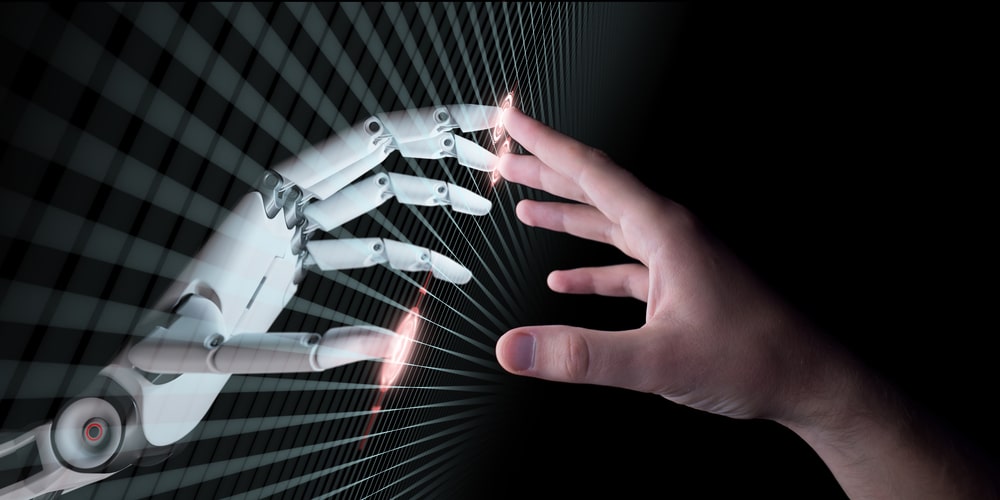

(OPINION) PNW – For years, researchers have warned of a system in which the government controls every aspect of its citizens’ lives. Every citizen would have to rely entirely on the government to survive in this system. This system has been openly discussed for many years by the “ruling class.” Aka: those who have been allotted social credit (or not) and power based upon their views and opinions.

The system has already begun in China and is now spreading globally In a recent post, “What is Really New In Fintech,” on the IMF blog (International Monetary Fund), authors Arnoud Boot, Peter Hoffmann, Luc Laeven, and Lev Ratnovski suggest “rapid technological change” in the financial industry.

Many social media and other online platforms are now creating and accepting payments. This revolutionary change in the banking world could change the face of finance forever. As a result of this rapid change, the authors bring up the following questions: What are the transformative aspects of recent financial innovation that can uproot finance as we know it?

Which new policy challenges will the transformation of finance bring?

To answer these questions, the authors wrote: Recent IMF and ECB staff research distinguishes two areas of financial innovation. One is information: new tools to collect and analyze data on customers, for example for determining creditworthiness.

Another is communication: new approaches to customer relationships and the distribution of financial products. We argue that each dimension contains some transformative components. The authors mention the importance and functionality of “determining creditworthiness.” The method they want to use to do so can be found in the section labeled “New Types Of Information,” where they write: READ MORE