Trending News

Grammy Award winner and American Idol contestant Mandisa dies at the age of 47

Grammy Award-winning singer and former American Idol contestant Mandisa Lynn Hundley, known...

Trending News

Netanyahu has done what the world warned him not to do

Israel’s strike on Iran on Friday morning will not come as a surprise to Western observers – but...

Is there more to this current “Bird Flu Panic” than what we are being told?

(OPINION) Why are global health officials issuing such ominous warnings about the bird flu? Do...

Alex Magala hits back at Mark Driscoll, says he’s a Christian and sword performance was meant to “inspire”

(OPINION) Alex Magala, the aerial sword-swallower and acrobat who admitted he stripped for gay men...

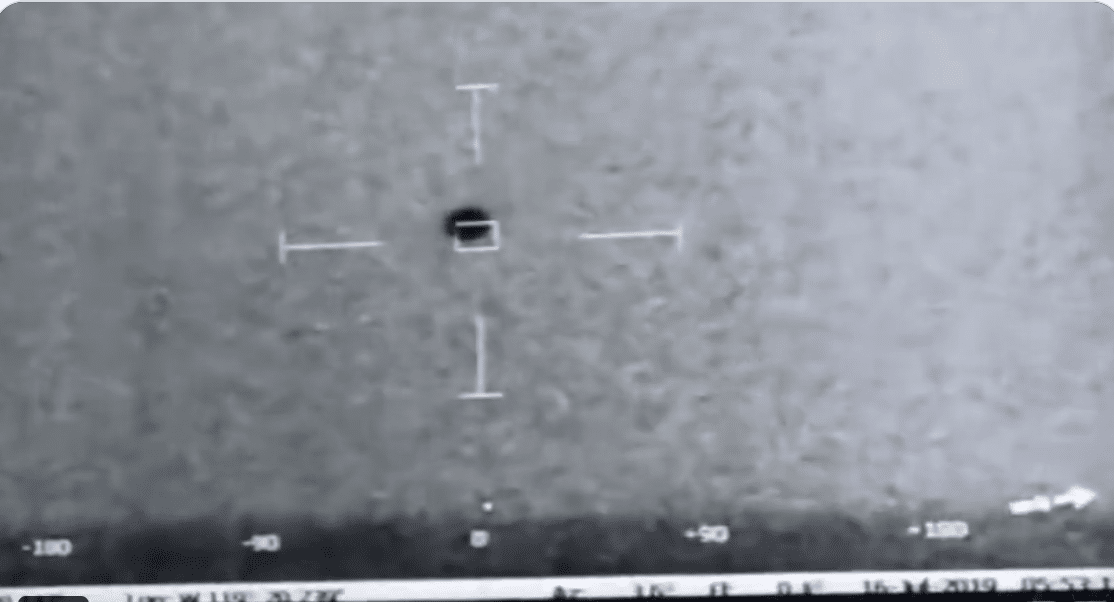

(WATCH) Former Naval Officer sounds the alarm regarding “World-Changing” underwater UFO captured on video

A report about a strange craft that appeared to defy both aerial and aquatic physics is apparently...

Iran threatens to target Israeli nuke facilities

The Middle East is on the “precipice” of a broader war that can be averted with a...

DEVELOPING: Reports indicate Israeli strikes have taken place in Iran, Syria, and Iraq

An Israeli missile strike targeted a site in Iran early Friday morning, according to ABC News. The...

Smart gun will require fingerprint and facial recognition technology to operate

A smart gun developed by Biofire will soon start shipping to customers who pre-ordered the...

Meteorologist warns of ‘Weather Wars’ between countries

Meteorologists have warned of potential “weather wars” between countries if cloud...

(NEW PODCAST) Number Of Black Eyed People Sightings Are Increasing

(OPINION) In tonight’s podcast, we discuss the alarming number of reports from eyewitness...

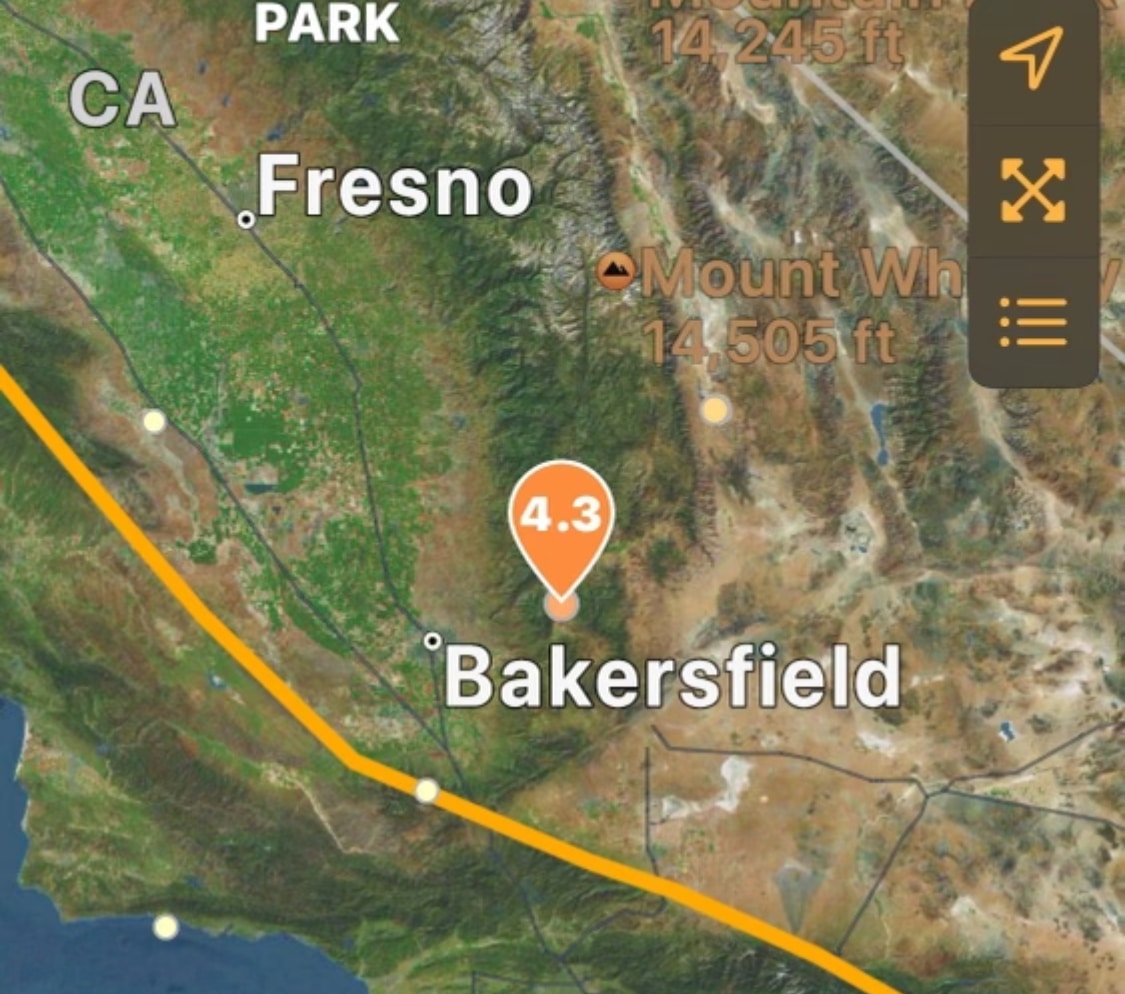

4.3 earthquake strikes near Bakersfield, CA

According to the United States Geological Survey, a 4.3 magnitude earthquake struck south of...

Two hunters ‘become first Americans to die from ZOMBIE DEER disease’ after eating infected meat

Two hunters may have become the first Americans to die from a ‘zombie deer’ disease....

Mystery flu spreading in Argentina ‘similar to Covid’ leaves over 60 people critically ill and doctors on “high alert”

In an outbreak that shares an eerie similarity with the arrival of Covid-19, a mystery illness has...