Trending News

DEVELOPING: Israel preparing to advance ground operation into Rafah

Israel’s military is poised to evacuate Palestinian civilians from Rafah and assault Hamas...

Trending News

Washington mother accused of stabbing 4-year-old son 41 times and dumping body on side of highway

A mother in the state of Washington is accused of stabbing her 4-year-old son 41 times and then...

DEVELOPING: Anti-Semitism growing in College Campuses across America

(OPINION) Imagine walking on your college campus or the campus your son or daughter attends and...

UN nuclear chief warns that Iran is ‘weeks, not months’ from enough uranium to make a bomb

The head of the United Nations nuclear watchdog has said that it would take Iran just weeks to...

FALLING AWAY: Bible engagement falls below 40% among Americans, continuing a decade-long decline

(OPINION) A comprehensive survey conducted by the American Bible Society, “State of the...

Nearly 2,000 students and 15 teachers walk out of LGBTQ ‘Indoctrination’ lesson in Minnesota

Nearly 2,000 Minnesota high school students opted out of an “LGBTQIA+ History and...

Peter Schiff says get ready for ‘major dollar decline’ — predicts end of greenback as global reserve currency

(OPINION) Economist Peter Schiff warned Americans to prepare for “a major dollar decline.” The...

Anti-Israel agitators vow to stay on campuses until administrators cave to their demands

Students at a growing number of U.S. colleges and universities are forming anti-Israel protest...

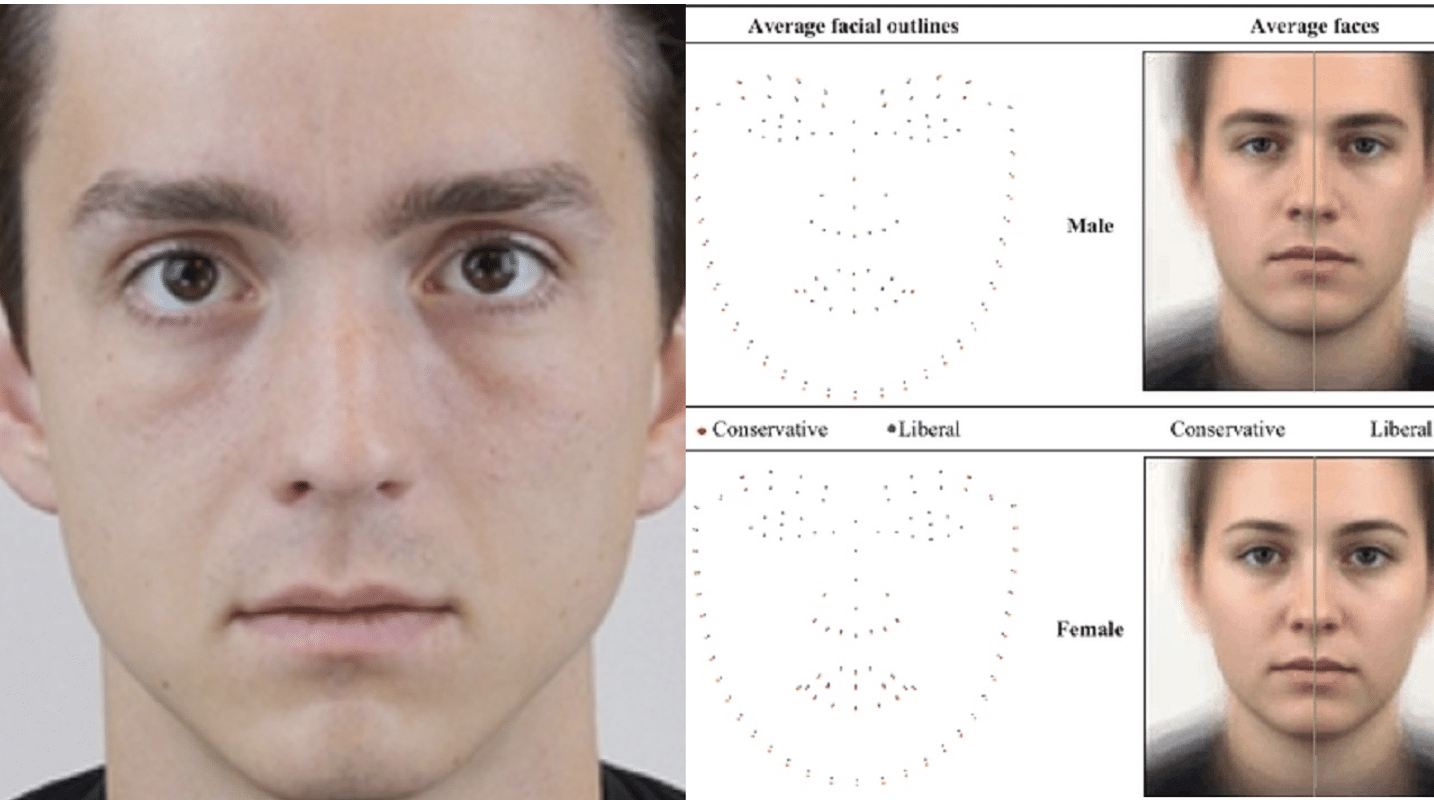

AI capable of predicting political orientations from blank faces

Researchers are warning that facial recognition technologies are “more threatening than...

Russian hackers remotely hack Texas drinking water

Russian hackers claiming to be backed by the Kremlin are believed to have remotely accessed a...

(NEW PODCAST) Are They Giving Us A Warning About What Is Coming?

(OPINION) In tonight’s podcast, we discuss a recent event that transpired in the UAE,...

North Korea issues nuke ‘warning signal’ to America and South Korea

North Korea’s missile test on Monday was in fact a drill to test nuclear force preparedness,...

Taylor Swift’s new song lyrics are explicit, demonic and blasphemous but many Christians refuse to stop listening to her music

(OPINION) Are Taylor Swift’s lyrics full of “explicit” content? It’s one thing to drop a...