Trending News

(NEW PODCAST) What Passover Means For The New Testament Believer

(OPINION) In tonight’s podcast, we discuss the season of Passover and why it is significant...

Trending News

PROPHECY WATCH: Will the Nations ‘Impose’ a “Peace Agreement” upon Israel?

(OPINION) This last week, when Iran unleashed its barrage of 350 drones and missiles against the...

UNRAVELING: Anti-Israel agitators form human chain as police descend on NYU campus

Anti-Israel protesters on the campus of New York University formed a human chain Monday evening as...

Does it matter that Steven Furtick’s Easter sweater had a $2000 price tag?

(OPINION) The outfit Pastor Steven Furtick wore on Easter is still generating online conversation,...

America’s fight to save handwriting from extinction as IQs begin to fall for first time ever and teachers warn some 20-year-olds can’t sign checks anymore

Several US states are trying to prevent handwriting from going extinct as classrooms increasingly...

Strong magnitude 6.3 earthquake strikes Taiwan

A 6.3-magnitude earthquake struck Taiwan’s eastern county of Hualien on Tuesday, the...

Google AI predicts rare ‘extreme weather events’ a week in advance – and could save people from ‘hazardous’ catastrophes

Google has developed a new artificial intelligence model that can help forecast weather. The AI...

Columbia University’s Rabbi tells Jewish students to go home over threat of violence

Rabbi Eli Buechler, the director of the OU-JLIC at Columbia/Barnard, is urging students to leave...

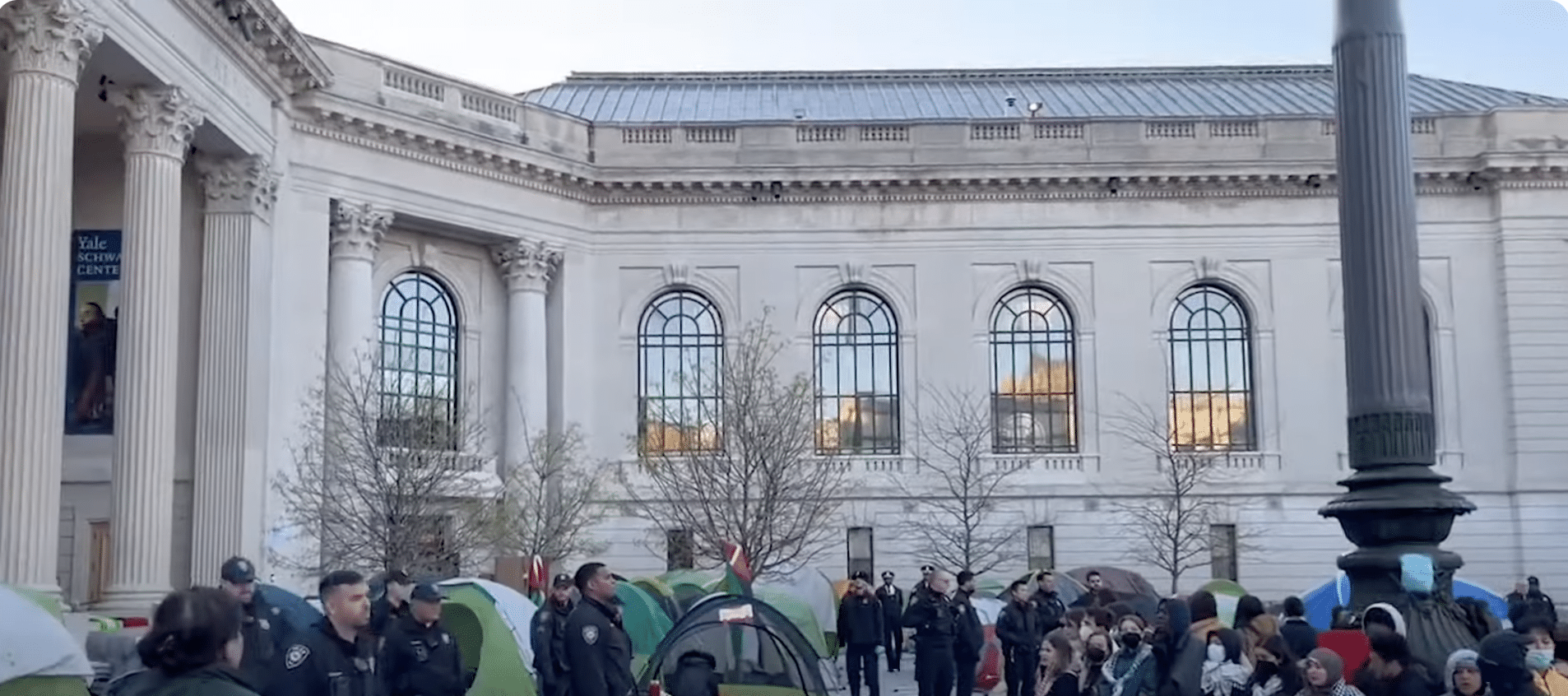

(WATCH) Police storm Yale University’s campus with riot gear, arrest students as hundreds stage anti-Israel protest

Police clad in riot gear swarmed Yale University’s Connecticut campus early Monday and started...

New report reveals that Israel struck Iran last week with a half-ton supersonic ‘Rampage’ missile

Israel used a long-range, supersonic missile in its strike on Iran last week, Israeli broadcaster...

Southern China is bracing for ‘Once A Century’ Floods

Landslides in southern China injured at least six people and trapped others, state media reported...

Multiple rockets have been fired from Iraq towards U.S. military base in Syria

At least five rockets were launched from Iraq’s town of Zummar towards a U.S. military base...

Drag queen cancels story hour at Pennsylvania church after backlash

A drag queen story hour event that was moved from a library venue to a theologically progressive...